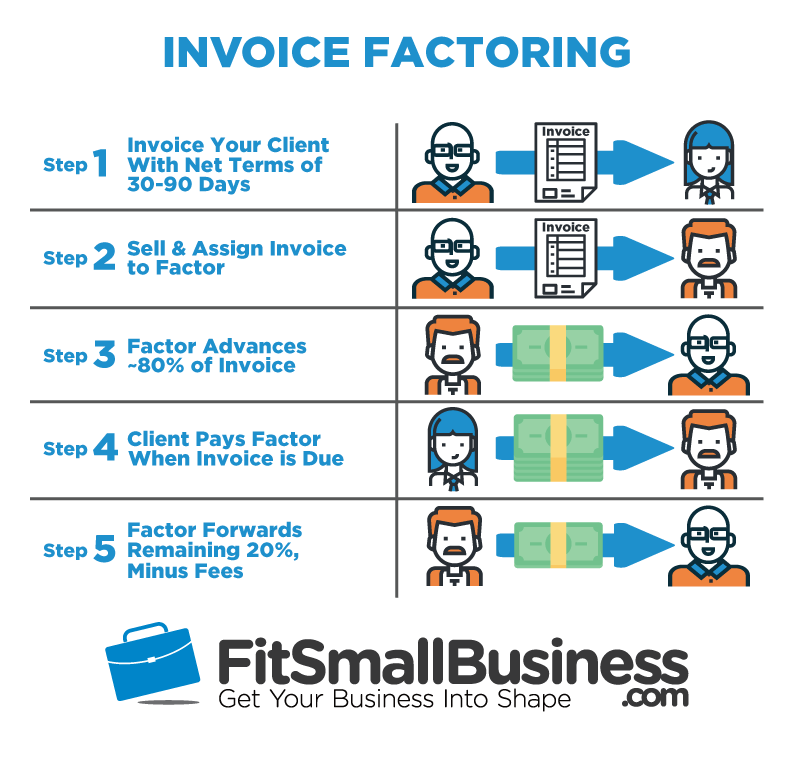

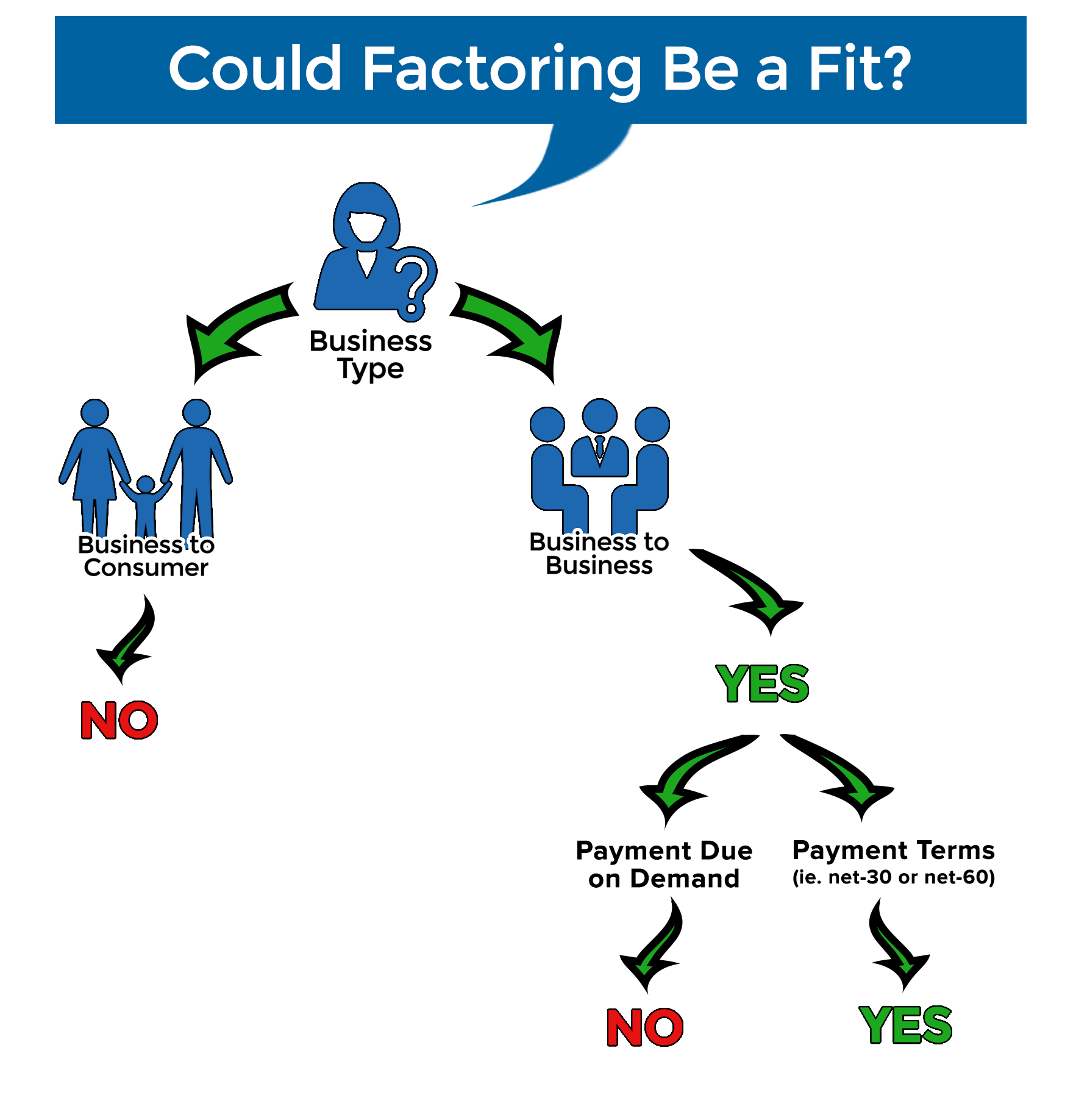

Factoring can help companies improve their short-term. Doing this monthly takes you to over 5,000 each year. A factor is essentially a funding source that agrees to pay the company the value of an invoice less a discount for commission and fees. Usually, the factor will then work with the end customers to collect payments, remove their fees and send the remaining income onto the company. Average fees for a 1,000 invoice would be 10 of the profit, depending on the company. Doing this monthly takes you to over 5,000 each year. Depending on the business, they may take over an element of the finance function from the business and advance a proportion of the funds (in relation to the invoice value) to the company soon after invoices are sent out. Average fees for a 1,000 invoice would be 10 of the profit, depending on the company. A finance company (the factor) will look at the strength of the customers, the borrower and further possible security offered. These are usually 30, 60, 90 and 120 day payment terms. In simple terms, a company will send out an invoice to a customer, who will have pre-agreed payment terms. However, the industry, size and growth trajectory of the business will all be looked at. FK Construction Funding Advance Rate: 80 Factoring Rate: 3 per 30 days, 4 per 45 days Minimum invoice amount: 50,000 FK Construction Funding has funded over 300 construction projects in 36 states. Most small business owners should understand that factoring typically works among specific B2B businesses. It is typically used with smaller businesses who have little or no credit control. Factor Funding has no maximum invoice amount, but they do require the invoice to be at least 6,000. Invoice factoring is one of the first alternatives many small business owners then turn to. This allows them to have more control and most invoices are discounted when they are sent out.

Invoice factoring is most typically used where the funder manages the customer collections and ledgers of the business.

0 kommentar(er)

0 kommentar(er)